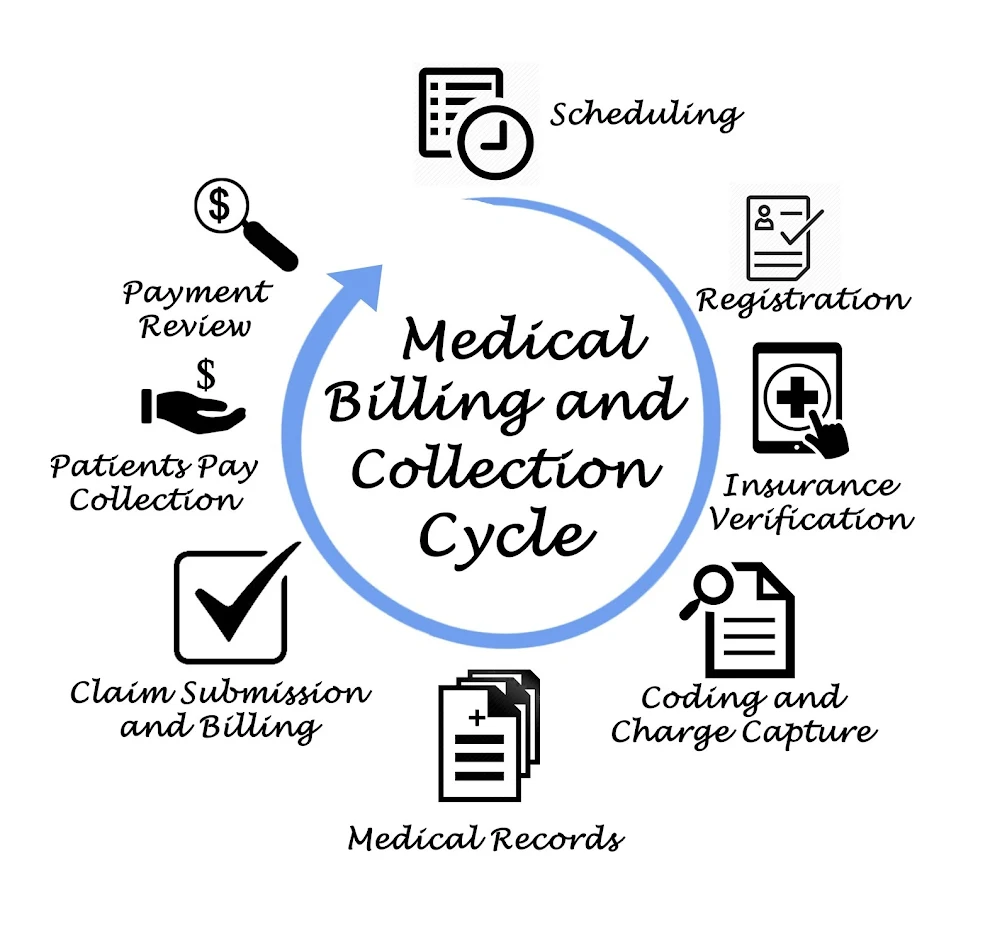

The most common errors in the submission of claims include inaccurate patient data, outdated insurance information, coding mistakes, missing documentation, and expired prior authorizations. Preventing these issues requires real-time eligibility checks, coding compliance tools, automated claim scrubbers, and strict workflow discipline to ensure clean, error-free claims are submitted on time.

The single biggest threat to a healthcare provider’s financial health is the denied claim. These rejections interrupt cash flow, waste staff time on rework, and drastically increase your operational costs. The submission of claims is the most critical step in the entire revenue cycle management (RCM) process, yet it is fraught with errors. According to the American Medical Association (AMA), health plans make errors in nearly 1 out of 5 claims, highlighting the massive need for systemic improvement in medical billing practices. To protect your revenue, you must proactively identify and fix the vulnerabilities in your claims submission process.

What are the Two Most Common Claim Submission Errors? (The Patient & Policy Foundation)

The vast majority of avoidable payment denials stem not from complex procedures, but from basic, foundational issues during patient intake. These administrative oversights are consistently ranked among what are the two most common claim submission errors. Ensuring accuracy during the submission of claims starts with eliminating these intake mistakes.

Inaccurate Patient and Insurance Data

This category represents the first line of defense against denials, and often, the first point of failure.

- Error 1: Patient Misidentification: This includes simple errors in patient names, dates of birth, or addresses. Even a minor discrepancy between the patient record and the insurance file can result in an immediate rejection. A Ponemon Report cited in industry blogs suggests that inaccurate patient identification contributes to a high percentage of denied claims.

- Prevention Strategy: Implement a mandatory, two-step verification at every patient encounter. Front-desk staff should compare the patient’s ID and insurance card against the system record.

- Error 2: Invalid or Outdated Insurance Details: Billing an inactive policy, using the wrong group ID, or forgetting to check for the current year’s deductible status.

Prevention Strategy: Utilize real-time eligibility (RTE) tools to verify coverage details before service delivery. A successful primary claims submission includes a patient who has coverage by an active, verified plan, confirming financial responsibility and benefit limitations upfront. This proactive check is essential for an efficient claim submission process in medical billing.

The Technical Triple Threat: Coding, Necessity, and Documentation

Once the administrative data is clean, the focus shifts to the clinical details. The technical elements of a claim, coding, and documentation must flawlessly align to prove the necessity of the service rendered.

Mitigating Medical Coding Errors

Denials are no longer siloed as a “billing department” problem. Successful denial management in healthcare requires true collaboration, meaning clinical, coding, and front-office teams must share responsibility and accountability for revenue integrity.

A critical requirement is the establishment of automated Feedback Loops. For instance, if a payer denies a specific CPT code due to a failure in prior authorization (PA), the front-end eligibility team needs immediate, automated notification to correct future PA requests. This eliminates the lag time where the same mistake is repeated hundreds of times.

To enforce this, 2026 RCM leaders must implement KPI Alignment. This involves tying denial rate metrics directly back to the originating department. For example, registration staff are measured on eligibility denial rates, while coders are measured on medical necessity denial rates. This shared accountability elevates healthcare denial management across the entire organization.

Documentation Gaps and Clinical Data Abstraction

A clean claim is always supported by comprehensive, accurate clinical notes. If the documentation is missing or inadequate, the claim lacks authoritativeness and will fail.

- Absence of Medical Necessity: The core of a denial often lies here: the services billed are not adequately justified by the provider’s notes. Payer audits rigorously scrutinize this.

- Error 6: Missing Supporting Documentation: Claim denials frequently occur when the submission of the claim lacks required attachments, such as:

- Referral forms

- Pathology reports

- Detailed operative reports

- Radiology interpretations

The process of clinical data abstraction, taking the precise, relevant information from the patient’s health record and converting it into billable codes, requires absolute precision. This step links the clinical experience to the financial transaction, and any breakdown here severely compromises the integrity of the submission of claims workflow.

What Common Errors Can Prevent Clean Claims? (Administrative Roadblocks)

Beyond coding and documentation, procedural and administrative rules set by payers frequently trip up billing teams, answering the question: What common errors can prevent clean claims?

Timing and Authorization Discrepancies

These errors relate purely to workflow and adherence to payer deadlines.

- Error 7: Invalid or Missing Prior Authorization (PA): Billing for a service that requires pre-approval without having the necessary authorization number, or letting the authorization expire. This is one of the most frustrating and costly denials.

- Error 8: Timely Filing Limit Exceeded: Missing the deadline for the submission of claim. Payer deadlines vary (e.g., 90 days, 180 days, or a year from the date of service), and exceeding them results in a hard denial that is usually unappealable. Strict internal deadlines and daily claim submission are the only way to avoid this.

Payer-Specific and Identification Issues

- Error 9: Provider ID and Credentialing Errors: Claims are often denied because the rendering provider’s NPI (National Provider Identifier) or Tax ID is incorrect, expired, or not credentialed with the specific payer. This is particularly crucial for complex payers like those handling medicare claim submission, which have strict credentialing requirements.

- Error 10: Inaccurate Place of Service (POS) Codes: Using a POS code (e.g., office, outpatient hospital) that does not match the actual location where the service was provided. This simple error can make a procedure appear non-compliant.

Prevention is Automation: Mastering Electronic Claim Submission

The only viable way to reduce your denial rate and improve your clean claim submission rate is by transitioning from manual checks to automated processes.

Electronic claim submission (EDI) is the foundation of a high-performing billing operation ensuring accuracy at every stage of the submission of claims process.

- Utilize Pre-Submission Claim Scrubbers: These sophisticated software tools review claims for hundreds of payer-specific rules before the claim leaves your system. They check for everything from mismatched POS codes to expired PAs, catching errors proactively.

- Integrate Practice Management Systems: A system where patient demographics, scheduling, clinical notes, and billing are connected minimizes the chance of data being manually corrupted between departments.

I-Conic Solutions understands that success in RCM lies in the details. We specialize in implementing advanced, integrated RCM platforms and offer expert claims submission services that leverage best-in-class scrubbing technology and dedicated billing analysts. Our goal is to manage your entire workflow to maximize your payment turnaround. Learn more about our solutions here: Claims Submission Services.

Conclusion: Your Path to a 95%+ Clean Claim Rate

Stop letting simple mistakes erode your bottom line. Achieving a high clean claim rate (95% or higher) is entirely possible, but it requires prioritizing technology, training, and workflow discipline. By focusing on cleaning up patient demographics, implementing stringent coding compliance, and leveraging the power of electronic claim submission and pre-submission scrubbing, you move your practice from reactive denial management to proactive revenue generation.

Ready to stop the revenue bleed caused by avoidable claim errors? Partner with the right RCM experts to secure your financial future.

Frequently Asked Questions (FAQ)

Electronic claim submission is the industry standard and most correct method for transmitting claim data. It utilizes electronic data interchange (EDI) via clearinghouses, offering automatic validation, faster processing, and real-time status tracking, all benefits that manual submission cannot match.

The overwhelming majority of claims today are submitted via electronic claim submission. This method is significantly preferred over paper claims due to its accuracy and the fact that most payers require it for high-volume transactions. This ensures an efficient and reliable process for submitting medical claims.

While data entry is a frequent issue, the single biggest cause of hard rejection is typically tied to a lack of substantiation: the provider’s documentation (or the resulting medical coding errors) fails to establish medical necessity for the billed service.